Toronto, Ontario — In this weekly Tuesday Ticker, Hertz plans to ditch more of its Tesla fleet, while BYD informs the federal government of its plans to enter the Canadian market.

Hertz hurts

Not only is vehicle rental company Hertz accelerating its plan to sell 100,000 Tesla units; but the company also plans to sell tens of thousands additional units this year.

Hertz announced alongside its earnings release Thursday that it expected “fleet overhaul” to be complete by the end of 2025, by which point the company’s monthly depreciation will normalize to the low $300s per unit, according to Bloomberg. Hertz currently sees a per-unit depreciation of about US$600 per month.

Hertz initially hoped its Tesla rental fleet would sell for as low as US$20,000, but the rental company has had to drop prices even further to clear out stock.

As of Friday at 11:30 a.m. ET, shares of Tesla were down more than eight percent from Thursday’s open, trading at US$208.49 per share. Tesla stock is down nearly 16 percent year-to-date.

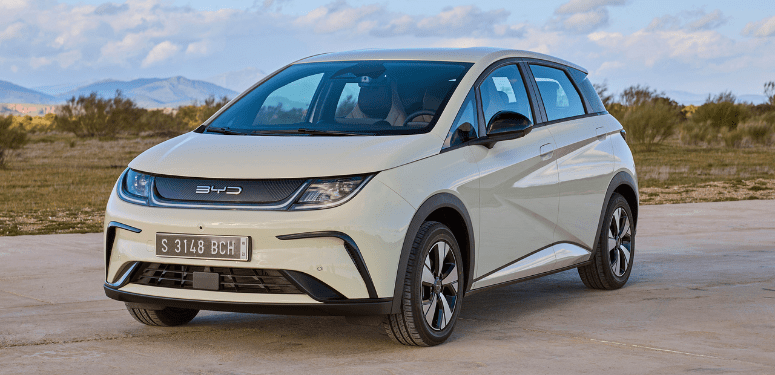

BYD’s bold move

Chinese automaker BYD had told the Canadian federal government it plans to enter the market, despite the government’s threats of tariffs on Chinese-made EVs.

Consultants working for BYD Canada Co. Ltd. filed a notice with the federal registry of lobbyists earlier last month, stating they were in discussions with Ottawa “to advise the government of Canada of matters related to the expected market entry of BYD into Canada for the sale of passenger electric vehicles, and the establishment of a new business,” according to a report from the Globe and Mail.

The filing also mentions that BYD seeks discussions with the government on the application of tariffs on EVs.

BYD is currently sold in global markets like Asia, Europe and South America. China does not sell any of its automotive brands in Canada.

The post Tuesday Ticker: Hertz to ‘accelerate’ sale of Tesla fleet; BYD seeks EV tariffs discussions with Ottawa appeared first on Collision Repair Magazine.