A 2023 Profile of the Evolving U.S. and Canada Collision Repair Marketplace

The 18th annual white paper, A 2023 Profile of the Evolving U.S. and Canadian Collision Repair Marketplace, is now available.

In this 18th edition of our annual white paper, we continue advancing our insights in the evolving U.S. and Canadian collision repair markets. As we move further away from COVID’s impact and the industry continues to normalize itself, we see growth in both the U.S. and Canadian markets represented by an all-time high U.S. TAM in 2023 of $50.0 billion up from $44.8 billion in 2022 and a Canadian TAM of Can$4.5 billion in 2023 up from Can$3.95 billion in 2022.

Throughout 2023, a more aggressive group of mid-size private-equity-funded consolidators accelerated both their single and multiple-location acquisitions and geographic diversity. Investor confidence in the collision repair industry has been boosted by what some see as the outsized industry financial performance.

The collision repair space continues to deliver its long-term proposition of proven economics and growth supported by insurance industry driven demand dynamics that create cash flow stability and profitability for many of the best operators. Over the past decade, because of this value proposition, we have seen the continued influence of private equity’s investment growth strategy targeting both larger and now smaller independent MLOs.

Collision Repair Industry

Some highlights of the 2023-24 collision repair industry:

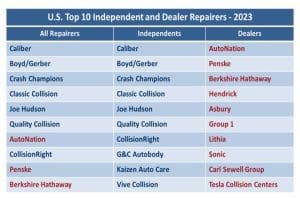

- Aggressive MLO consolidators such as VIVE, Open Road, CollisionRight, and Quality Collision Group are building their regional and super-regional platforms to compete with larger legacy consolidator MLOs like Caliber, Boyd/Gerber, Crash Champions, Classic Collision, and Joe Hudson.

- Private-equity investors continue to see potential in the collision repair industry and can be viewed as a proxy for what we believe will continue within the collision repair space throughout the remainder of this decade.

- The industry continues to prove out its favorable year-over-year, non-cyclical sustainable cash flow, recession resistance, and growing market due to a consistent number of repairable vehicles and rising severity.

- The collision repair space continues to deliver its long-term proposition of proven economics and growth supported by insurance-industry-driven demand dynamics that create cash flow stability and profitability for many of the best operators.

- With regard to physical growth, the benefits and risks to all consolidators continue to be the ability to quickly, efficiently, and effectively integrate expansion and acquisitions. This includes managing and navigating new market dynamics and scale, growing their client and revenue base, the ability to balance ongoing insurance DRP and OEM certification program requirements, leveraging supplier relationships and the economies of purchasing power, as well as their ability to effectively integrate their systems and business operating model within their new single-and multiple-location markets.

- With capital continuing to flow to larger MLOs and consolidators, single location and smaller MLOs that are not able to expand and establish a reasonable degree of market scale will continue to find it increasingly difficult to compete.

- While dealership body shop sales increased in 2023 and through the first six months of 2024, the percentage of dealers operating collision repair facilities continued to decline.

Multiple Location Operator, MLO, Segmentation

Throughout this report, we segment U.S. collision repair organizations in a variety of ways:

- Independents

- Dealers

- Top three consolidators

- ≥$20M Multiple-Locations Operators (MLOs)

- $10M-$19M MLOs

- ≤$10M MLOs

- Franchise/Banner/Multiple-Location Network (MLN)

- Private equity and other investor-sponsored MLOs

- All other remaining relevant repairers

The ≥$20M segment, especially the top three independent consolidators, Caliber, Boyd/Gerber, and Crash Champions, continue to grow steadily, underpinning the long-term collision repair consolidation trend. Their marketplace leadership continues due to:

- Increasing levels of regional and national network scale.

- Organic revenue growth based on market scale, brand recognition and network performance.

- Insurer DRP and OEM certification relationships.

- Customer acquisition segmentation.

- Multiple-location platform acquisitions.

- A steady number of strategically placed geographic single-location acquisitions coupled with greenfield and brownfield development.

- Ability to integrate acquisitions and implement operational and performance improvement.

- Ability to leverage capital expenditures for future growth and development.

Canadian Market

It was announced and reinforced in early 2024 by the Environment and Climate Change Minister Steven Guilbeault that Canada has finalized its Electric Vehicle Availability Standard, phasing out new ICE vehicle sales and requiring 100 percent of vehicle sales to be zero-emission by 2035.

As of year-end 2023, Canadians had access to 10,666 public charging stations with about 26,000 individual chargers which was supported by private infrastructure investments accelerating the pace of installations. Nevertheless, analysis by Natural Resources of Canada showed that these totals are a fraction of the infrastructure required to support an all-electric fleet.

In late 2023, Quebec became the first Canadian province to pass a law on consumers’ right to repair that includes the automotive industry. This sets an important precedent for Canada to follow and adopt legislation that guarantees consumers the right to repair their automobiles with the service provider of their choice.

When ranking all the types of repair organizations, the first two positions in the All-Repairers ranking are represented by two Franchisors. The remaining companies reflect a combination of independent and dealer, banner and franchise organizations.

Industry Trends

- Both the U.S. and Canadian auto insurance markets remain highly consolidated, with the top ten private carriers controlling the majority share of premiums written and commanding most claims processed and settled.

- The top three auto insurers in both the U.S. and Canada continue to have a strong and disproportionate market share when compared to their peers. This high market share gives these top carriers the scale and clout to substantially influence the various dynamic claims processing models and the leverage to influence which repair providers participate in their DRP and preferred provider programs.

- Consolidators continue to market their “one national/regional shop model/platform” to insurers and their OEM partners, promoting their large marketplace network of available collision repair locations throughout multiple regions and the U.S.

- Some high-performing regional MLOs are opting out of some insurer DRP programs to avoid the number of constraints and perceived roadblocks encountered when performing repairs to DRP standards versus repairing vehicles to OEM-recommended standards.

- Average repair costs continue to increase due to greater repair complexity, higher inflation-based labor expenses, more parts and higher parts costs coupled with supply chain issues, diagnostic scans and calibrations, and new costly materials such as aluminum and carbon fiber.

Our five-year forecast to 2028 has the ≥$20 million segment and the Top 3 Consolidators aggressively growing their businesses while maintaining their significant market share lead over the Franchise Networks and the $10-$19M MLO segments. We expect that by 2028, the Top 3 Consolidators will grow from their 2023 market share of over 24 percent to up to 37 percent.

Our annual report, A 2023 Profile of the Evolving U.S. and Canada Collision Repair Marketplace, is now available. The report contains the complete results of our research and analysis for 2023, including over 70 charts and graphs throughout more than 90 pages with historical trends and a future view.

The report can be purchased by contacting Mary Jane Kurowski of The Romans Group LLC at maryjane@romans-group.com

The post Romans’ Report: A 2023 Profile of the Evolving U.S. and Canada Collision Repair Marketplace appeared first on Collision Repair Magazine.